Share

Originally published as a customer exclusive 02.11.23. Revised and updated February 2024.

Introduction

A year ago Sophus3 published an overview of the entry of Chinese brands into the European car market. In the first part of this article we look at the progress they have made since that time, reexamine their unfolding strategies, and identify in more detail the new and likely future entrants—more than forty five brands in all. A more detailed listing of all of these brands is published as an appendix.

In section 2 we turn to the Chinese brands’ online presence and share the findings of our recent survey of their digital platforms. The survey looks at the websites of 17 of the new arrivals across 13 European markets to understand the expansion of their digital footprint and their capabilities.

The question that is coming to the forefront is how will the incumbent brands respond to the new entrants, and, more significantly, what support will they enlist from national and regional governments to address what some commentators see as an existential threat to the European car industry? We look at those arguments in the third and concluding section.

Executive summary

Strategy and progress

- Overcapacity and declining margins in their home market make Europe attractive to the Chinese brands.

- 47 brands are listed as active or potential European entrants.

- Advantages in technology and manufacture mean that the Chinese OEM’s focus is on Electric Vehicles (EVs).

- The new entrants are following a gradualist approach, launching in smaller, EV-friendly markets before scaling their operations.

- The majority of brands are utilising a conventional franchised dealer network; only three are using a direct to consumer model exclusively.

- Progress in Europe is at an early stage with their combined market share below 3%.

- Recent new entrants include Chery, Li Auto and Zeekr

Website survey

- The sites of 17 Chinese groups/brands were analysed across 13 European markets.

- There were 86 active sites out of a possible 221.

- The highest number of Chinese brand web platforms were found in Sweden (11).

- Polestar was present in the most markets (12).

- The sites’ feature sets and functionalities remain limited in some key areas.

- 37% allow the customer to reserve a car online.

- Ecommerce is the primary retail channel for only three brands (Nio, Polestar and Xpeng).

- The Chinese brands’ digital audience share remains small but is growing rapidly; their highest share is in Norway (12%).

Industry and government responses

- European car makers perceive the Chinese entrants as a threat but are divided as to their response.

- Brands with significant sales in China fear being excluded from the market in retaliation for any increase in European tariffs.

- The high margins Chinese OEMs enjoy could mean that the impact of tariffs is limited.

- France and Italy are looking at alternative strategies to counter the new entrants by favouring home manufacturers.

- Consumer voices have, so far, been excluded from the policy debate.

1. Chinese car brands' year of progress

Motivation

The drivers for Chinese car brands’ entry into the European car market remain the same, and, if anything, the factors encouraging their entry have hardened over the last twelve months.

The Chinese car market is suffering problems that are all too familiar from a European industry perspective. Over capacity is seeing too many manufacturers chasing too few customers. This has led to a discounting price war that commenced at the start of the year and which has eaten heavily into car makers’ margins. It has also proven counter-productive, with car sales falling for a number of months as consumers sat back and deferred purchase in the expectation of further price reductions. The seriousness of the situation was underlined by the comments of Zhu Huarong, head of Changan, China’s largest state owned car company, who in May said he expected 60% or more of Chinese car brands trading today to be forced out of business in the next two to three years.

These factors in the home market, along with the encouragement of the Chinese state, have made Chinese car brands turn to export markets. The European market is particularly attractive for a number of reasons. New vehicles here command higher prices and therefore deliver greater margins. European brands are struggling to deliver affordable electric vehicles (EVs), despite the fact that the region is committed to a transition to zero emission vehicles by 2035 (earlier in the case of some countries). Chinese brands enjoy a lead in EV and battery technology as well as supply chain integration. They can therefore deliver electric cars at cheaper prices with the additional benefit of lower labour costs.

At the same time the European economy is facing its own problems which further assist the new entrants. Inflation and remedial interest rate increases are squeezing consumers’ disposable incomes and making affordable, ‘budget’ products increasingly attractive in every sector.

Chinese entrants’ strategy

Whilst there are variations in the way Chinese car brands are approaching the European car market, clear patterns, if not a template, are emerging.

Firstly, the majority recognise the EV market is their main opportunity and are making this their priority. Brands like BYD for example are offering an ‘EV only’ product line up, despite manufacturing ICE (internal combustion engine) vehicles for other markets.

Most are following a gradualist approach in their roll out, targeting smaller markets first—Scandinavia in particular, where there are higher levels of EV adoption and government support—before venturing into the larger Big 5 countries where greater scale, and investment, will be required.

Lastly, we are seeing the majority adopt a conventional retail model and building ‘bricks-and-mortar’ dealer networks in partnership with established dealer groups. Only three brands—Nio, Polestar and Xpeng—are utilising an exclusively online / direct to consumer approach. This may change, but for the moment, the Chinese brands seem focused on the rapid establishment of a credible fulfilment capability through conventional franchise arrangements. It is perhaps ironic that these new disruptors might actually be a lifeline for the traditional sales model as more and more of the European brands pressure their dealer partners into an agency relationship or explore D2C (direct to consumer) sales channels.

Current progress

Whilst the focus on export markets is working on a global scale in favour of Chinese brands—at the end of 2023 China overtook Japan as the world’s largest vehicle exporter with 4.91million of its cars sold abroad—the reality is that in Europe they have barely got started.

In 2023 just 350,000 Chinese cars were sold in the major European markets according to Schmidt Automotive Research, which equates to just 3% of the market. However, the longer term trend is positive, with Chinese manufacturers’ market share increased from just 0.1% in 2019. More significantly, their share of the EV market on which they are so heavily focused, stands at a respectable 10%.

More brands arriving

Our detailed analysis shows that more Chinese car makers are looking to compete in Europe. You can see our full listing of new and potential Chinese OEM entrants here. We include the current players, those that have announced their intention to enter the market in the near future, and those that seem likely to, given the suitability of their products for a European audience. We have identified and listed +45 brands and groups in all.

There have been some significant recent developments. Chery, the largest Chinese exporter globally, has announced it will shortly be targeting Europe through its Omoda, Jaecoo, and Exlantix brands. More premium brands are also appearing with Li Auto, and Zeekr recently sharing their timetable for entry into Europe.

Those brands already in Europe are cranking up their product offensives with the likes of Polestar and Nio adding attractive new models. The incumbent brands are waking up to the fact that this incursion into their market isn’t solely around price. Quality and engineering excellence are strong elements in the appeal of the new brands and as such these entrants pose a threat to the established manufacturers across multiple market segments.

2. Chinese car brands' digital presence

Introduction

We first carried out a survey of Chinese car makers’ digital platforms in Europe one year ago. The scope has been extended with both the number of markets and brands looked at increased as we track their expanding presence as they bid for European market share. The aim of the survey remains the same: to understand both the extent and quality of these new entrant’s digital capabilities.

About the survey

The survey of Chinese car brands’ European websites was conducted in August 2023. The purpose of the survey was to:

- identify which Chinese brands have a digital presence and in which European markets

- review the content and functionality each site offers its visitors

- define the retail model the brands are following and see what proportion offer transactional interaction

In each market we also measured the volume of traffic to Chinese brand sites relative to overall traffic so as to see how their share of the digital audience is evolving.

The markets we looked at

The new Chinese entrants are understandably focused on markets which present the best immediate opportunity for them. These are the Big 5 markets—Germany, France, Italy, Spain and the UK—which between them account for 70% of all European sales. In addition, many are also targeting the wealthier Northern European markets where electric vehicles are winning higher market share. This edition of the survey therefore took in the following countries:

- Belgium

- Denmark

- Finland

- France

- Germany

- Iceland

- Italy

- The Netherlands

- Norway

- Spain

- Sweden

- Switzerland

- United Kingdom

(Belgium, Finland, Iceland, Switzerland were the new additions included in the study.)

The brands we tracked

Whilst our review of Chinese manufacturers lists around 40 actual or potential European market entrants, currently we have identified 17 where intent has translated into a firm presence, with vehicles available to purchase and the digital real estate to support their commercial activity. There remain a large number of Chinese brands who could be defined as in a holding pattern – having announced their intention to begin European sales but as yet with no operational or digital footprint in place to support sales activity.

The brands we looked at were therefore as follows

- Aiways

- BYD

- Changan

- DFSK

- Haval

- Hongqi

- JAC

- Maxus

- MG

- NIO

- Omoda

- ORA

- Polestar

- Seres

- Wey

- Xpeng

- Zeekr

(Changan, Haval, Omoda and Zeekr were the ‘new’ brands added in this edition of the study.)

Site features and functionality

The survey looked at each individual site to see which of the following features and functionality were available.

Model pages

Pages listing and describing the individual models in the brand’s range. (Absence of these pages indicates that sales are not imminent in that market)

Derivative level pricing

If the model page contains detailed pricing this indicates ‘real’ as opposed to future availability of vehicles.

Configurator

A configurator is an interactive tool that allows a prospective buyer to select and view a graphic representation of a car model and choose their preferred colour and equipment combinations. The configurator conforms to a set of business rules that means the user can only create a finished combination of elements that the manufacturer is able to supply.

Test drive request area

At its most basic level this is an interactive form through which the site visitor can submit a request to book a test drive of a vehicle they are considering for purchase. The page will generally utilise mapping and calendar functionality so that the visitor can find a dealership near to their location and share a time that is convenient for them for the test.

Live Chat

This is messaging, voice or video functionality (or a combination of the three) that allows a site visitor to interact with a brand representative in real time to ask questions about a vehicle or the purchase process.

Register interest/subscribe to newsletter

Again this is a simple form where a visitor can request to receive information in different formats or ask for a company representative to contact them.

Finance/leasing information

Finance pages give information about the different methods of financing a car purchase that a brand’s captive finance house, or finance partner, can offer prospective buyers.

Find a dealer

This may be simple directory listing or more sophisticated mapping functionality that enables a customer to make contact with a dealership or showroom.

Full ecommerce facility

We define this as a combination of functionalities that makes it possible for the buyer to perform all the steps of a purchase online through to reserving a car, without the need to visit a physical outlet during that ordering process.

Retail network or direct to consumer?

Lastly, we define the retail model that the site is supporting. Is this ‘direct to consumer’ (d2c) —as followed by Tesla as well as Mercedes and Volvo in some markets —or does it support the traditional model utilising a network of franchised dealerships?

Findings: Markets and brands

Our expanded survey found 74 active websites for Chinese brands out of a possible 221 in the group of markets we looked at. That equates to 33% penetration by these brands in those markets.

Sweden remains the market with the highest representation of Chinese brand entrants and continues to be the favoured launchpad for these brands. Whilst Norway is seen as having a more favourable taxation and policy framework to support the electric car market, Sweden has around double the number of annual sales as its neighbour. There is also the coincidental fact that Gothenburg is the home of Volvo and functions as the HQ for other brands in the Geely Group stable making it their logical first launch market. Germany and Norway both have 10 brands with active sites. The slow rate of EV adoption in Italy and Spain explains their lower ranking, but perhaps the biggest surprise is the paucity of Chinese brands in France given its first mover status resulting from home brand Renault’s early foray into EV manufacture. Currently only four Chinese brands are present there.

| Chinese car brand entrants by market | |

|---|---|

| SE | 11 |

| DE | 10 |

| NO | 10 |

| DK | 9 |

| NL | 9 |

| UK | 7 |

| IT | 6 |

| BE | 5 |

| ES | 5 |

Polestar then MG, Aiways and BYD are present in the most European markets. Polestar remains absent from the French market despite more than a year ago having reportedly settled its dispute with Citroën over the similarity of its logo to that of the DS brand. BYD, which is now present in 10 markets, seems to have met the ambitious expansion targets it set when it launched into Europe just over one year ago.

Polestar had the highest number of websites in our survey and was present in 12 markets.

Chinese car brand entry by market |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BE | CH | DE | DK | ES | FI | FR | IS | IT | NL | NO | SE | UK | ||

| Aiways | 10 | ✔ | ✔ | ✔ | ✔ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✖ | ✔ | ✖ |

| BYD | 10 | ✔ | ✖ | ✔ | ✔ | ✔ | ✖ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Changan | 1 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ |

| DFSK | 3 | ✖ | ✖ | ✔ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ |

| Haval | 1 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ |

| Hongqi | 5 | ✖ | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✔ | ✖ | ✔ | ✔ | ✔ | ✖ |

| JAC | 3 | ✖ | ✔ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ | ✖ |

| Maxus | 8 | ✔ | ✖ | ✔ | ✔ | ✖ | ✔ | ✖ | ✔ | ✖ | ✖ | ✔ | ✔ | ✔ |

| MG | 11 | ✔ | ✖ | ✔ | ✔ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| NIO | 5 | ✖ | ✖ | ✔ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✔ | ✔ | ✖ |

| Omoda | 1 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ |

| ORA | 3 | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✔ |

| Polestar | 12 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Seres | 4 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ | ✔ | ✔ | ✔ | ✖ | ✖ |

| Voyah | 1 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ | ✖ |

| Wey | 1 | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ |

| Xpeng | 4 | ✖ | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✔ | ✔ | ✖ |

| Zeekr | 3 | ✖ | ✖ | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✖ | ✔ | ✖ |

Site features and functionality

The figures in the table below show the percentage of sites that offer the different content, features and functionality that were described earlier. For comparison we show the percentages for the smaller set of websites that were surveyed in 2022.

Chinese brand site features and functionality |

||

| 2023 | 2022 | |

| Model pages | 98% | 96% |

| Derivative level pricing | 91% | 75% |

| Configurator | 63% | 55% |

| Test drive | 85% | 79% |

| Live Chat | 9% | 38% |

| Register interest/ subscribe | 73% | 77% |

| Finance/leasing | 34% | 39% |

| Find a dealer | 93% | 79% |

| Full ecommerce | 37% | 29% |

What is evident from the survey is that these brands’ sites are becoming more complete in core areas, but still have some distance to go before they offer the full suite of functionalities that the European car buyer is accustomed to.

The fact that most brands now show detailed, derivative level pricing indicates that the majority of them are genuinely ‘in market’, with vehicles that can be ordered rather than being teased before introduction at some future point. Similarly the increase in the percentage of sites with dealer locator functionality and test drive request pages, shows that, likewise, pretty much all of these brands now have fulfilment capabilities in place and can react to customer inquiries rather than just harvest ‘expressions of interest’.

The percentage of sites with a functioning car configurator does appear on the low side, although this may be a conscious choice on the part of these brands. Tesla, for example, has always had fairly minimal configurator functionality on its sites, very different from the highly rendered and 360° viewable presentations offered by its competitors. It may be that some of these new Chinese entrants are following a similar pared-down path, particularly when their model ranges are small with high levels of standard equipment but few optional items on offer.

The ‘configurator’ on Seres website in France is no more than a simple page with links to guide the viewer through the equipment and options available for their single model. As such it is a perfectly adequate if unspectacular solution.

A more glaring omission would seem to be the lack of information about vehicle finance—whether this is provided by a brand’s own finance house or by a partner. In most cases the approach is to refer the potential customer to a local dealer to learn about the finance packages available. However, this means sites lack even the most basic guidance as to the monthly payments a buyer would need to budget for. The only representation of the cost of ownership available to them therefore is the on-the-road cash price, a figure which, particularly in the case of EVs, we know can be very daunting.

The low uptake of these brands of live chat functionality is perhaps the most surprising, particularly as the proportion of sites utilising it has decreased markedly as they have expanded into more European markets. Given the low public awareness of these car makers it is to be expected that potential customers will want some reassurance before transacting with these unfamiliar brands. The availability of one-to-one interactions with local agents can quickly build that trust in a way that no amount of abstract ‘brand building’ can.

Despite what might objectively be perceived as short-comings in some aspects of the online offer of these brands, the percentage of them able to offer online purchase has increased over the past year. Over a third (37%) of our list of Chinese brands now offer ecommerce in at least one market. However there is still a gap between this subset of brands and automotive brands as a whole. In the UK for example 70% of the top 30 brands allow you to reserve a car online, whilst in The Netherlands 58% offer this facility.

Retail network or direct to consumer?

Our research shows that the majority of Chinese brands entering the European market are currently utilising a traditional dealer network arrangement and promoting contact to this through their websites—93% of them have links to contact their network.

In total 11 of the brands we analysed offer some form of ecommerce capability. For some brands this is market dependent, with the likes of MG (Denmark) and BYD (Denmark and Netherlands) experimenting with online ordering in certain markets. For other brands, Nio, Polestar and Xpeng, ecommerce is their primary approach to retail.

Chinese brands using ecommerce |

|

| Aiways | DE, ES |

| BYD | DK, NL, BE |

| DFSK | SE |

| Hongqi | NL |

| MG | DK |

| NIO | DE, DK, NL, NO, SE |

| ORA | UK |

| Polestar | BE, CH, DE, DK, ES, FI, IT, NK, NO, SE, UK |

| Voyah | NO |

| Xpeng | DK, NL, NO, SE |

| Zeekr | NL, SE |

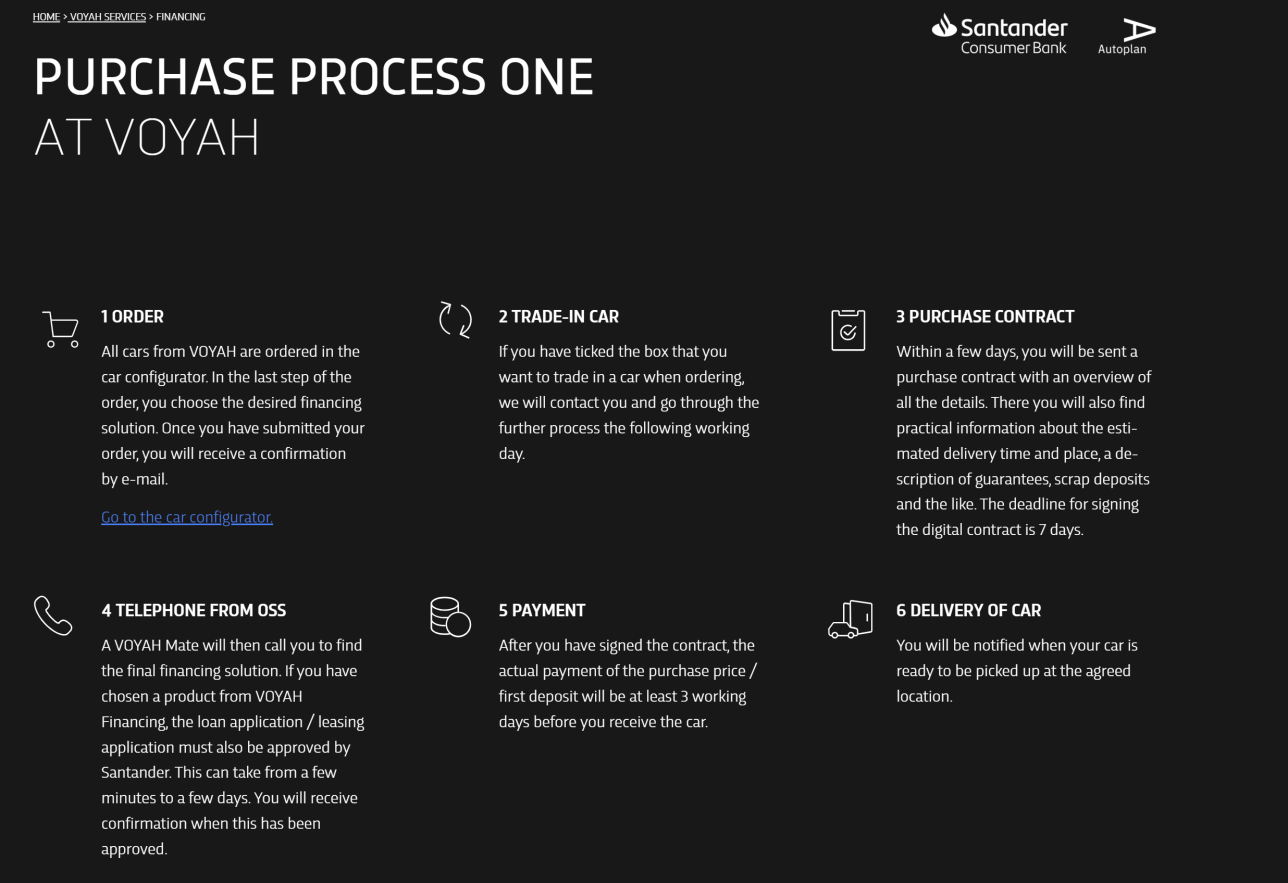

Voyah has simple and clear guidance for customers to order their car online.

37% of active sites now offer full ecommerce (the ability to reserve or purchase a stock or build-to-order vehicle entirely on the website). We are seeing many incumbent automotive brands begin to experiment with online purchase, whether that be model specific (Ford Mach-e), channel specific (Škoda subscription) or market specific (MG Denmark). Despite this, we know that automotive ecommerce across Europe is still in its infancy with the majority of customers choosing some form of real world contact before making a purchase decision. Less than 1% of visits view the start of an ecommerce journey with drop out rate beyond that being very high.

Share of digital audience

So how successful have the Chinese car makers’ digital activities been in growing their share of the audience for automotive brand websites since we last measured their performance? In 2022 we described their digital presence in many markets as ‘negligible’. In those countries where they are just commencing activity that remains the case, but in markets where they have been active longer they are beginning to see a return for their efforts. In the Scandinavian markets their share of audience is respectable. In Norway Chinese brands are advancing both in terms of awareness and sales. Last July for example BYD’s Atto was the top selling model – events such as that feed a virtuous circle of interest in Chinese brands and their products that grows their audience and translates into further sales. But what is equally significant in the markets that we highlight below, is not so much the size of the audience, but the rate at which it is increasing. It is also worth remembering that, so far, this growth seems to have been achieved with little recourse to big budget advertising.

Chinese brands digital market share |

|||

| H1 2022 | H1 2023 | +/- | |

| Norway | 5.9% | 12.2% | 108% |

| Sweden | 4.3% | 7.5% | 77% |

| Netherlands | 1.8% | 4.9% | 167% |

| Germany | 1.4% | 3.0% | 116% |

| UK | 0.8% | 3.0% | 273% |

Members of Sophus3’s eDataXchange project can request the detailed breakdown by brand and market through contact@sophus3.com.

3. Looking ahead: industry and government responses to the new entrants

Our short review shows that there are now around 40 individual Chinese brands with either an active or potential interest in targeting the European car market. They range from small, dynamic start-ups to huge, state-owned conglomerates and they offer vehicles anywhere between cheap and cheerful city cars to luxury SUVs and supercars. These insurgent brands are, on the whole, well resourced and, what is more, driven to a large extent by desperation born out of a worsening situation in their home market.

It is therefore not surprising that European car makers view the Chinese brands’ ambitions as hugely threatening: in the short term to their market share, and, in the longer term perhaps to their very existence.

But European brands are divided as to the correct response to these perceived threats. On the one hand you have a clear protectionist viewpoint, articulated by Stellantis CEO Carlos Tavares, who has demanded higher tariffs be imposed on Chinese cars brought into Europe: “If we don’t protect the industry in this period and we keep this vulnerability to Chinese imports, it creates a bigger risk where we will lose our industry.”

However, brands for whom China is a significant market take an opposite view, fearing being excluded by a tit-for-tat response from the Chinese government to any imposition of additional tariffs. Ola Kallenius, the head of Mercedes—for whom China is a source of a third of its sales—voiced this position in a recent interview: “Let us keep markets open and let market participants fight it out.”

Governments, both national and regional, are at the very least concerned about the long term, structural implications for car manufacture, which remains a huge generator of wealth and employs more than 2.5 million Europeans.

In September 2023 the European Commission president, Ursula von der Leyen, announced an anti-subsidy investigation into Chinese electric vehicles. Evidence of uncompetitive activity would lead to the imposition of increased tariffs on their importation. Whilst the investigation is expected to take over a year to complete, higher tariffs looks probable, with a likely outcome being an equalisation of the duty paid on Chinese cars entering Europe to match the 25% paid on European cars sold in China. Currently Chinese vehicle imports into the EU are subject to just a 10% tariff.

However, there is some justifiable scepticism as to whether this would have much impact given the huge cost advantage cars manufacturers in China enjoy. In April, Nio founder William Li, addressing the inevitability of protectionist measures as Chinese brands expanded globally, stated that Nio and its peers enjoyed a 20% cost advantage over their non-Chinese rivals. However, there may have been a certain coyness in Li’s calculation, particularly if we consider the budget end of the vehicle market.

For example, in China, Leapmotor sells its T03 model for the equivalent of €7,500; in France the price of the same model starts at €26,500.

Leapmotor is by no means the exception. We took a basket of a dozen Chinese vehicles which are available in both Europe and China and found the price of the European versions of the cars were, on average, 60% more than in China. Even allowing for higher distribution and marketing costs in the European market, this differential would be capable of absorbing all but the highest tariff increases. Would the European Commission be prepared to raise the stakes and impose those higher tariffs, an action almost certain to precipitate a full scale trade war? At the moment that seems unlikely.

National governments are looking at other ways to counter the ‘Chinese threat’. Many are taking a lead from the US administration’s explicitly protectionist Inflation Reduction Act which targets EV subsidies and tax credits to benefit US manufacturers and suppliers, banning battery components “manufactured or assembled by a foreign entity of concern”.

In Europe, the current EV subsidy regimes follow a more scattergun approach. Recent figures from Italy showed that 80% of the incentives they distributed to encourage EV purchase were used to buy non-Italian manufactured cars. The Italian government says they will shortly announce policy measures to address this.

The French administration is attempting some difficult policy contortions to shift the eligibility for EV subsidy to benefit home manufacturers. From 2024, every EV model is assessed in a way that includes the manufacturing process in the calculation of its CO2 footprint. Chinese factories’ dependence on coal fired electric generation excludes their vehicles from receiving the €5-7k EV subsidies on offer. In a harbinger of likely future conflicts if the European Union were to impose measures to limit the import of Chinese cars, the Chinese government has responded to the French administration’s actions with the announcement of their own probe into imports of French brandy.

But collectively, these measures are likely to prove counterproductive. The Chinese brands, particularly the larger groups, are hugely strategic and see the path ahead as their ‘long march’ to achieve growth and reach. From a global perspective, any retreat into regional protectionism would work in their favour longer term. They would be the brands retaining access to the world’s largest car market—China— whilst it would be Western brands excluded from that market as well as the battery supply chain on which they currently depend if they are to scale up their EV sales in other markets.

Whatever the outcome of these debates, it is worth noting that the unquestioned priority in all of them is the interests of European car manufacturers above those of European consumers. The latter, if asked, might well be in favour of at least having the choice of buying a potentially cheaper and more environmentally friendly car?

Appendix: Listing the new and future entrants

Aion, Aiways, Arcfox, BYD, Changan, Chery, Deepal, Denza, DFSK, Dongfeng, Fang Cheng Bao, Farizon, Forthing, GAC, Geely, Geometry, Great Wall, GWM Pickup, Haval, HiPhi, Hongqi, JAC Motors, Jaecoo, JMEV, Landian, Leapmotor, Li Auto, London Electric Vehicle Company, Lotus, Lynk & Co, Maxus, MG, NIO, Omoda, ORA, Polestar, Qiyuan, SAIC, Seres, Smart, Voyah, WEY, XPENG, YangWang, Zeekr.

Aion

Although currently not present in Europe, Aion’s Hyper GT—a sedan with unusual scissor doors that claims the lowest aerodynamic drag of any production car—has received much interest in China and is to be launched in Thailand. Parent group GAC may consider Europe a viable target market at some point in the future. In June the company said it would be revealing its global strategy later in the year and stated its objective was to sell one million cars annually from 2025.

The Aion Hyper GT

Aiways

Aiways is currently achieving sales in nine European markets for its U5 and U6 models, utilising a D2C (direct to consumer) distribution model. It was expected to expand further in 2023, including launching into the UK. However, there has been recent speculation in the Chinese press about the startup’s future with reports that it is running into cash flow difficulties. Aiways might be an early victim in the wave of consolidation expected as a result of the ongoing price war and other difficulties gathering pace in their home market.

Arcfox

Despite suggestions that Arcfox, a part of BAIC group, would be launching into Europe after showing two of its models at the Geneva motor show in 2019, this has yet to happen. However, the vehicle previewed at that time, the ArcFox α-T, was released in China in 2020. It is manufactured in Zhenjiang through a joint venture with Magna Steyr, whose plant in Graz, Austria, already builds EVs for Fisker and Jaguar under contract. In September Uwe Geissinger, Magna Steyr’s president, revealed that the company was in talks with an unnamed Chinese manufacturer to provide production facilities in Europe.

BYD

BYD has become the Chinese car group of perhaps most interest to the incumbent European car manufacturers. In China, BYD has this year overtaken Volkswagen as the biggest selling brand—a position the German OEM has held since 2008. It has also pushed Tesla into second place in BEV (Battery Electric Vehicle) sales, with 1.3 million BEV units registered in China during the year.

Whilst registrations within the 12 European markets in which it is active remain small—around the 16,000 mark for the year—sales are accelerating, and itthe brand had already exceeded its 2022 European registration total by the midpoint of 2023.

BYD is currently rolling out its Dolphin model into Europe, a direct competitor with Volkswagen’s ID.3, but attractively priced below €30,000.

The BYD Dolphin

Until now Tesla has been the yardstick for success in the EV market that many other car makers have sought to emulate. BYD is noticeably following a very different strategy from Tesla’s pared down approach that is currently reliant on just four models. Instead, BYD is emulating the automotive conglomerates it seeks to displace by developing multiple sub-brands and products to address every corner of the global car market. In April, BYD announced the Seagull—a sub-€9,000 EV viable in many emerging markets. In July it launched a Tesla Model Y competitor utilising the Denza brand. Shortly after it teased a large SUV, the Leopard 5, which will be sold under a new, fifth sub-brand, Fang Cheng Bao. At a January 2024 presentation in Shenzhen company officials confirmed that both the Leopard and the luxury YangWang U8 were being considered for export to Europe, although under a ‘westernised’ brand name.

“We want to be in the top three” brands in the region by the end of the decade and number one “if we can,” Michael Shu, European head of BYD said in a recent interview in the Financial Times.

To secure its longer term future in Europe BYD has recently revealed two major strategic advances. Firstly, its plan to open a factory in Hungary which would allow it to circumvent current and future tariffs imposed on Chinese made vehicles. Secondly, the company is acquiring its own fleet of Roll-on/Roll-off car transporters to safeguard future deliveries to Europe and other overseas markets.

Changan

The oldest Chinese car manufacturer has two sub-brands with the potential to expand into global markets: Qiyuan and Deepal. The company has stated plans to achieve sales of 5 million vehicles by 2030, with over 60% of these New Energy Vehicle sales and 30% export sales.

Chery

Historically, Chery is China’s largest vehicle exporter. In a significant announcement in 2022 it said it would start bringing its cars to Europe utilising the Omoda and Jaecoo brands. Until now Chery vehicles have only been available in Europe rebadged by DR Automobiles who currently sell them in Italy and Spain, with plans to expand to France and Bulgaria.

In October 2023 Chery said that its all-electric brand Exlantix would also commence European sales from 2025.

Chery doubled the number of cars it exported worldwide in 2023 to 937,148 vehicles.

Deepal

At a launch event for its S7 model, Changan‘s chairman, Zhu Huarong, announced expansion into the ASEAN and European markets as part of the strategy for the Deepal sub-brand to generate 1.5 million annual sales. However, he gave no timeline as to when this would commence. The S7 is pitched as yet another rival to the Tesla Model Y but offered at nearly half the price in Deepal’s home market.

Denza

BYD’s premium brand was, initially, a 50-50 joint venture with Mercedes with the latter still holding a 10% share in the company. In late 2023, Denza showed its first vehicle to be launched in Europe, the D9, a luxury/executive battery electric minivan that will compete with Mercedes V-Class and Volkswagen Multivan. At present there is no indication of when the vehicle will be launched or in which markets.

The Denza D9 is pitched as a BEV rival to the Mercedes V-Class

DFSK

DFSK (Dongfeng Sokon Automobile) was part of the Dongfeng group selling light commercial and utility vehicles but divested from it in 2019 under the Sokon Group (now renamed the Seres Group) However it still trades using the Dongfeng logo. The situation is further complicated in that Seres brand models produced by the current owner/parent group are also registered in some markets under the DFSK brand. The brand’s website continues to list operations in Cyprus, Slovakia, Czech Republic, Hungary, Germany, Italy, Croatia, Macedonia, The Netherlands, Spain, Switzerland, and the UK but there appears to have been no expansion of the network over the last year.

Dongfeng

Dongfeng is the third largest of the state-owned Chinese ‘Big Four’ automotive manufacturers. It is an umbrella for a number of brands although currently only DFSK, which in fact it no longer owns, Forthing and Voyah, are active or will soon be active in Europe.

Fang Cheng Bao

Fang Cheng Bao is the fifth sub-brand that BYD has launched, currently offering just one model, the Leopard 5, a high-end competitor to the Mercedes G-Klasse and Land Rover Defender. Given the parent company’s ambitions for rapid global expansion, the Leopard will likely receive a European launch, although as a plug-in hybrid it does not fit the current ‘BEV only’ strategy BYD has adopted in Europe.

Farizon

Geely’s LCV brand, Farizon, will start delivering vans into Europe in 2024. Founded in 2016, the company makes a range of vehicles including methane fuelled Heavy trucks and fully autonomous vehicles for use in enclosed environments, such as warehouses and building sites.

The introductory vehicle in Europe will be the SuperVAN—a fully electric vehicle built on Geely’s Multi-Purpose Architecture (GMA) which utilises drive by wire rather than mechanical componentry. This effectively isolates the vehicle platform from the vehicle body allowing a simplified, modular approach to vehicle construction and delivering greater flexibility and variation in the finished vehicles that can be delivered.

Geely’s GMA platform underpins Farizon’s SuperVAN

Forthing

A sub-brand of Dongfeng, Forthing showed its U-Tour V9 at the 2023 IAA Munich motor show. The luxury/executive minivan segment is becoming a highly competitive niche within the Chinese market, but it is unclear whether this or similar offerings from Denza or Voyah, will arouse much interest in Europe or challenge the dominance of Mercedes and Volkswagen.

GAC

The fifth largest, and state-owned Chinese automobile group. GAC is involved with multiple joint ventures with Honda, Toyota, Mitsubishi and BYD in its home market. Currently it is not selling in Europe, but its own EV dedicated brand Aion may be a potential entrant.

Geely

Zhejiang Geely Holding Group was China’s first privately owned automotive OEM when it formed in 1997. It bought Volvo from Ford in 2010 and since then has expanded the number of brands under its control to a dozen or more.

Geely has recently become even more active within the European EV market through the following brands: Farizon, Geometry, London Electric Vehicle Company, Lotus, Lynk & Co, Polestar, Smart, and Zeekr. Details of their activities are given under their separate brand listings.

In 2023, Geely increased its share in sports car manufacturer Aston Martin to 17%, taking a seat on the board and becoming the company’s third largest shareholder.

Geometry

As yet Geely is giving little prominence to this badge in Europe, preferring to utilise its more premium brands to achieve a favourable positioning of its products. However, in November 2022 a deal was signed with Hungarian importer GACE to distribute the Geometry C in Hungary, the Czech Republic and Slovakia. Geometry continues to be hugely successful in other export markets, such as Israel, where it is the country’s number two top selling electric vehicle brand after BYD.

Great Wall

Great Wall Motor Group (GWM) opened its European HQ in Munich in late 2021 and has since opened ‘brand experience centres’ in other European cities.

GWM initially launched the WEY and ORA brands into Europe following their appearance at the 2022 Paris motor show. (GWM Pickup and Haval had both been active in areas of Eastern Europe for longer.)

In November 2023 Great Wall announced it was renaming the two new entrants as GWM WEY and GWM ORA and would be changing the names of current models to align with European tastes.

GWM Pickup

The Great Wall Motors own badge is used exclusively for the sale of pickup trucks with which the group made its name. It retains assembly plants for knock down vehicles in Russia and Bulgaria with a focus on sales in the former Soviet bloc.

Haval

GWM’s SUV brand, Haval, continues to confine its European presence to Belarus, Bulgaria, Moldova, Russia, and Ukraine. However the global strategy for the brand is shifting to include a mix of new energy vehicles as Haval has lost sales to BYD in its home market. Longer term therefore we may see the Haval badge in Western European markets.

HiPhi

Human Horizons—HiPhi was a Chinese brand new to Europe that had begun selling its luxury EV range at the end of 2023. Established in 2016 the range consisted of three models: the HiPhi X, a ‘super’ SUV/Crossover, the Z, a coupe/Grand Tourer, and the Y, a large SUV featuring gullwing doors. However, in February 2024 the brand announced it was shuttering its factory in Yancheng for six months, following the closure of stores in China during January. Even if the brand does manage to secure a financial lifeline and resume production—which seems unlikely—then a return to Europe would be some years away.

HiPhi Model Z

Hongqi

Described as ‘China’s Rolls Royce’ and as ‘Chairman Mao’s favourite car brand’, Hongqi, part of the FAW group, launched its luxury electric SUV the EHS9, in Norway and the Netherlands in 2022, distributing the vehicle through small, local dealer groups in both markets. Since then Hongqi has also become available in Denmark through the KW Bruun Group.

JAC Motors

JAC continues to sell small numbers of cars in Europe, primarily through Auto Kunz AG in Wohlen, Switzerland. At the beginning of last year the car maker made a larger shipment of e-JS4 cars to Norway, selling 122 units in 2023, as well as fulfilling orders for its N75EV light trucks from utility companies and municipalities in France and Spain.

Jaecoo

This sub-brand of Chery will bring the Jacecoo 7 model, initially to the UK, where it will share showroom space with Chery’s Omoda brand models. In October the regional director of Chery announced that Jaecoo and Omoda would soon launch in ‘all major European markets’ including Germany, Spain, Italy, and France.

JMEV

JMEV (Jiangling Group Electric Vehicle) manufactures the Limo, a four door saloon EV, through a joint venture with Renault. This vehicle is offered on a subscription basis to private hire/ride hailing drivers through Renault Group’s Mobilize brand.

Landian

Established in only April 2023, Landian is another sub-brand of Seres with technology supplied by BYD and Huawei. The first model, the Landian E5 PHEV, a mid-size SUV, began shipping to ‘Belt and Road’ markets in the summer of 2023. Landian could be another potential disruptor in the European market with a ‘budget’ EV SUV offering.

Leapmotor

Founded in 2015 and initially financed through an established electronics company, Dahau, Leapmotor is now ranked 15th in the Chinese New Energy Vehicle market and is listed on the Hong Kong exchange. It offers four models in China with seven more planned for release by the end of 2025.

From 2023 the brand has entered Europe, and initially is only available in France, where just their smallest and cheapest model is on sale: the T03 hatchback. The car is distributed through one outlet, EVE (Espace Véhicule Électrique), in Toulouse, a large EV multi brand showroom with plans to expand to multiple sites.

For the moment Leapmotor appears to be holding the T03 vehicle back from introduction into other European countries. At the IAA Munich Leapmotor gave most emphasis to the global launch of its C10 SUV and announced that it would launch a further five models for export to Europe and elsewhere over the next two years.

In October 2023 Stellantis announced it was taking a 21% stake in Leapmotofor for US$1.6billion. The deal gives Stellantis exclusive rights to sell Leapmotor’s vehicles and use the brand’s technology outside of China.

In February 2024 it was announced that Stellantis was considering using its Mirafiori plant in Turin, Italy to manufacture Leapmotor models. This would ‘onshore’ production, avoiding the 10% EU tariffs on cars from China which are likely to increase later this year. It could also diffuse the developing spat between the group and Italy’s ‘post-fascist’ Prime Minister, Giorgia Meloni, who has accused the car maker of displaying bias towards French interests.

Leapmotor’s stand at the IAA Munich 2023.

Li Auto

Li Auto is yet another Chinese start-up that has rapidly expanded and recently announced its intention to sell into Europe. The brand takes its name from founder Li Xiang whose background was online retail of electronic goods (PcPop.com founded 1999) which broadened into car accessories, then selling cars themselves through the Autohome site.

Li Auto is listed on the Nasdaq and Hong Kong stock exchanges. It currently ranks 6th in China’s new energy vehicle market although it only commenced mass-production in 2020, it has three models, the Li L7, Li L8, and Li L9, with four more planned for 2024.

“Li Auto will not enter overseas markets before 2025 … In overseas markets, Li Auto will maintain its direct sales model.” Li Xiang (July 2023). In February, Li made an intervention on social media arguing that the Chinese government needed to lead a rapid consolidation mechanism for the auto industry to address overcapacity and to avoid the social costs of business failures and closures.

London Electric Vehicle Company

LEVC, the UK based Geely subsidiary, continues to roll out its TX EV model which now make up 40% of London’s Black Cab fleet. In March 2023 the 10,000th TX was delivered from its Coventry factory. Later in the year, LEVC showed its new Space Oriented Architecture (SOA) vehicle platform which could allow the manufacturer to diversify into light commercial vehicles, larger people carriers, and motorhomes.

In January of this year LEVC showed a high-spec, eight-seat eMPV that will be launched within the next two years, named the L380.

10,000 and counting—a milestone for LEVC production of its TX model was passed in March.

Lotus

Since Geely acquired control of Lotus in 2017 the marque has shifted to an all-electric future with the Evija supercar and Eletre SUV already added to the range. An all electric four-door saloon described as a hyper GT car will be released in 2024. Originally codenamed the Type 133, it will be named the Emeya, and is positioned by the company’s marketeers as a Porsche Taycan rival.

Whilst sales of Lotus cars in the European Big 5 almost tripled over the previous year, the majority of these were of the ICE powered Emira ‘junior supercar’, with a concentration of those sales in the UK.

Lynk & Co

Jointly owned by Geely and Volvo, Lynk & Co offers its 01 model, a hybrid SUV, on a subscription basis. ‘Members’, as the company describes its customers, pay a monthly fee for use of their car which can be shared with designated family members or friends.

In 2022 the company claims it increased membership numbers from 60,000 to 170,000 in the markets in which it now operates: Sweden, the Netherlands, Italy, Germany, Belgium, France, and Spain.

In an interview with Automotive News Europe in May 2023, CEO Alan Visser said that the company would in the near future expand operations into Norway, Austria, Switzerland and the UK.

Lynk & Co will release a new fully electric model, the 02, in 2024.

In Germany the 01 is currently offered on subscription at €600 a month for up to 1250 km, with road tax, servicing and insurance included. The starting price to purchase the 01 outright is €46,000.

Maxus

Maxus is SAIC Group’s commercial vehicle brand. The shortage of vans with EV drivetrains has handed the company a huge opportunity as there is a niche but rapidly expanding demand for these vehicles for use in urban low emission zones. Reuters reports that SAIC “sold 18,000 mostly electric Maxus brand vehicles in Western Europe and Scandinavia” in 2022 and that Maxus had “around 6% of Europe’s new ECV market…up 28% versus 2021”

MG

MG, part of the SAIC group, is currently the best selling Chinese car maker in Europe. MG enjoys several advantages over its compatriot brands. It is the longest established, selling Chinese built cars in the region since 2011. It is still perceived by many Europeans as a British heritage or premium brand with consumers remaining largely unaware of its transfer of ownership to SAIC’s forbear in 2005. Its previous mix of ICE and EV models has given it a footprint in all of the Big 5 markets which it can exploit as it transitions to solely BEV models. No other Chinese manufacturer, as yet, enjoys that reach in these markets which, between them, account for more than 70% of the region’s total sales.

In the first half of 2023 MG sold 88,457 units in the Big 5, a 132% increase over the same period in the previous year, placing the company ahead of the likes of Mazda, Mini, and Jeep.

Much of the brand’s recent performance rests on the success of the MG4 EV hatchback which is probably the region’s most affordable electric model. In France for example, the headline price of this MG4 is below €23,000 when adjusted to include the government ecological bonus. The model is offered there on a LLD (long duration lease) at €99 a month.

MG will be hoping to repeat this success in a different market segment with the release of the Cyberster two-seat roadster during 2024.

NIO

Over the last year EV start-up NIO has expanded its operations in Europe, and is now present in Norway, Denmark, Sweden, Germany, and The Netherlands. It is also expected to commence sales in the UK in the medium term. In addition, NIO has expanded its range in Europe to a choice of six models.

NIO is near unique in building cars with removable batteries which the user can quickly swap for a fully charged battery at a dedicated swap station. The challenge for NIO remains creating an extensive network of these stations to ensure prospective users feel confident in the solution—although the batteries can also be topped up using a standard DC charger.

NIO’s future was given more certainty in June when it won backing from an investment arm of the Abu Dhabi government.

Nio is launching its own brand smartphone in China to enhance the car ownership experience through the provision of a range of connected services. This move also has a clear strategic dimension which is to allow the brand to retain control of user and vehicle data and to lock other phone suppliers out of this evolving value chain.

Nio opened its first German battery swap station in September 2022.

Omoda

This sub-brand of Chery will start selling the C5 crossover in the UK beginning early 2024. This first vehicle is being offered with a choice of a gasoline or fully electric powertrain, with hybrid versions to follow. Pricing indicates that the model will be the cheapest in its market segment, where it sits alongside Nissan Qashqai, Kia Sportage and other mid-sized ‘soft roaders’.

Omoda is looking to build initially a network of 50 dealers in the UK; the brand’s plans for other European markets have yet to be clarified.

The Omoda C5 which will be available first in the UK from March 2024.

GWM ORA

GWM ORA is Great Wall‘s pure electric brand, launched in Europe in 2022 with initially one model, the Funky Cat. It currently sells in Sweden, Germany, Ireland and the UK. In November the model name was revised to Ora 03.

In 2024 it will introduce a second model, the Ora 07 which sells as the Lightning Cat in China, a retro-designed four door saloon positioned to rival Tesla’s Model 3.

The Ora 07, badged as the Lightning Cat in its home market, will launch in Europe in 2024.

Polestar

Whilst describing itself as a Swedish brand—its headquarters are in Torslanda, Sweden, and Volvo is the major shareholder—Polestar’s vehicles are manufactured exclusively in China. In 2022 the company was listed on Nasdaq by means of a special purpose acquisition company (SPAC).

Polestar registrations more than doubled in the European market during 2023 H1 and the brand has commenced a product offensive to further increase market share.

Polestar 2 is now available in Europe and is a pure electric 5 door ‘fastback’ (a hatchback with a sedan/coupe profile). Polestar 3, is a large electric SUV, available to order now for delivery in late 2023.

Polestar 4 is an SUV Coupe that will launch in China, with production beginning there in November 2023. The European introduction is planned for early 2024.

Polestar 6 is an electric roadster expected in 2026.

Polestar recently followed Nio’s lead in announcing the launch of its own brand smartphone to act as the owner interface with its vehicles. Presently this capability is only offered in the Chinese market.

Polestar’s Chengdu plant: the facility runs on 100% renewable electricity.

Qiyuan

A sub-brand of Changan, Qiyuan was launched in August 2023 with an announced annual sales target of 1.5 million units globally by 2030. Three model ranges were announced at launch—the A-series, Q-series, and E0-series. The brand will use EV powertrains exclusively for all of these. Whilst no launch timetable for release to export markets has yet been announced, given both the ambitious sales targets and the product profile of the new brand, then a future European launch looks near inevitable.

Qiuyan’s first vehicle, the A07 is a mid-size sedan.

SAIC

SAIC Motor is China’s largest and state-owned vehicle manufacturer which exports to Europe using the MG and Maxus brands.

SAIC recently entered an agreement with Audi to share technology and platforms belonging to its premium EV brand, IM Motors. Industry commentators noted that this was a significant milestone in the development of the Chinese automotive industry with a reversal in the traditional direction of technology transfer.

Seres

Seres is one of a number of car brands under the larger Seres Group.

The group is working with Huawei to develop intelligent driving systems for a family of vehicles that are also being launched under the Aito brand. These cars utilise Huawei’s Harmony OS as an alternative to the Android operating system.

The first examples of the SUV Seres 5 EV model were delivered in Norway in July 2023. The same vehicle is sold in China as the Aioto M5 EV.

A further sub-brand of Seres Group is Landian.

Seres’ sales performance in Europe is confused by its previous association with Dongfeng so that in some markets its sales are assigned to DFSK.

Smart

Since January 2020 the Smart brand has been restructured as a joint venture between the former owner Mercedes-Benz and Geely. All cars in the future will be pure EVs, designed by Mercedes-Benz and built in dedicated factories in China by Geely. So far two vehicles have appeared—both launched initially in the Chinese market. The Smart #1 is a small crossover SUV model.

In Europe Smart vehicles will continue to be distributed through the existing Mercedes-Benz dealer network. However, the #1 will be the first car sold through an agency arrangement with dealers who reportedly receive a 7% commission for each new vehicle sold.

The Smart #3 appeared at the Shanghai Motor Show in April and will launch in Europe in 2024. The car is a midsize SUV with similar dimensions to the VW ID.5—a final rupture with Smart’s traditional ‘microcar’ positioning.

Smart #3 first show in Europe at IAA Munich in September 2023.

Voyah

Voyah is a premium EV sub-brand of Dongfeng. Currently in Europe it operates only in Norway with showrooms in Oslo and Trondheim. It has one model, the Free sedan, which will soon be joined by the Dreamer, a large MPV, which received European type approval in August 2023. In July the brand signed agreements with local dealers in the Netherlands, Switzerland, Denmark, and Finland with sales commencing in these markets in the final quarter of the year.

Voyah Dreamer is another new entry by a Chinese brand into the executive/luxury MPV segment.

GWM WEY

Part of Great Wall, WEY showed its Coffee 01 and Coffee 02 PHEVs at the 2022 Paris Mondial de l’Automobile. At the time it said that, in partnership with Emil Frey Group, it would roll out these models commencing in Germany from the start of 2023. However, there is little evidence that the brand is currently selling in any European market other than Germany, and even there with barely a dozen sales in 2023. Whilst the brand is listed on the emilfrey.de website there are no individual GWM WEY vehicles showing as available. In November 2023 the brand announced that as part of its parent company’s ‘One GWM’ plan it would be changing the model names of the Coffee 01 to the GWM Wey 05 and the Coffee 02 to the GWM Wey 03

XPENG

Currently XPENG is selling its cars in Denmark, Norway, Sweden and the Netherlands, with more than 700 vehicles registered in these three markets during 2022. At the IAA Munich in September 2023, Xpeng’s Chairman, Brian Hu, announced that sales would commence in 2024 of three models in Germany and France and a single right hand drive model in the U.K. The brand is committed to a ‘classic sales model’ in these markets, delivered in partnership with established dealer groups in each country.

YangWang

BYD’s luxury brand has three models in the pipeline: the U8, a flagship SUV (Google “U8 Tank Turn video” to view some of this vehicle’s capabilities), the U9 electric supercar and, most recently a third offering, the U6 sedan competing with Mercedes EQS, Porsche Taycan and Tesla’s Model S Plaid. BYD has yet to announce an intention of introducing their luxury marque into Europe, although like Fang Cheng Bao, it is easy to see the potential for models of this type amongst European luxury car buyers. YangWang is utilising a direct sales model in its home market with showrooms located in business districts within major cities.

YangWang’s first store opens in the commercial district of Shanghai in September 2023. 90 direct managed stores are to open across Chinese cities in the next 12 months.

Zeekr

Another name plate under the Geely Group umbrella, Zeekr is a pure EV brand launched in 2021. In June 2023 it announced that the Zeekr 001, a ‘luxury shooting brake’, and the Zeekr X SUV were available for order in Sweden and the Netherlands. Germany, France, Denmark, and Norway are timetabled to follow in 2024.

Initially the brand will create flagship showrooms in Amsterdam and Stockholm, but will follow an online business model, stating that it wishes to avoid the “inherent inefficiency in the traditional distribution system”.