Share

In this latest extract from Sophus3’s Automotive Digital Summit 2023 Scott Gairns examines the differences in car-buyer interest between different global regions and suggest some possible reasons for the large variations.

Transcript:

“Sophus3 works with 23 auto brands globally to build an accurate picture of today’s digital car buying trends, and our latest analysis reveals some clear divides between Europe and the Americas.

After some years of experimentation with new models of mobility which have achieved only limited traction, innovation is starting to become more business critical, not least because of the effect of the economic squeeze.

An amazing 6 million fewer cars were manufactured in 2022 compared with 2019, resulting in average lead times for a new car of up to six months, according to many analysts.

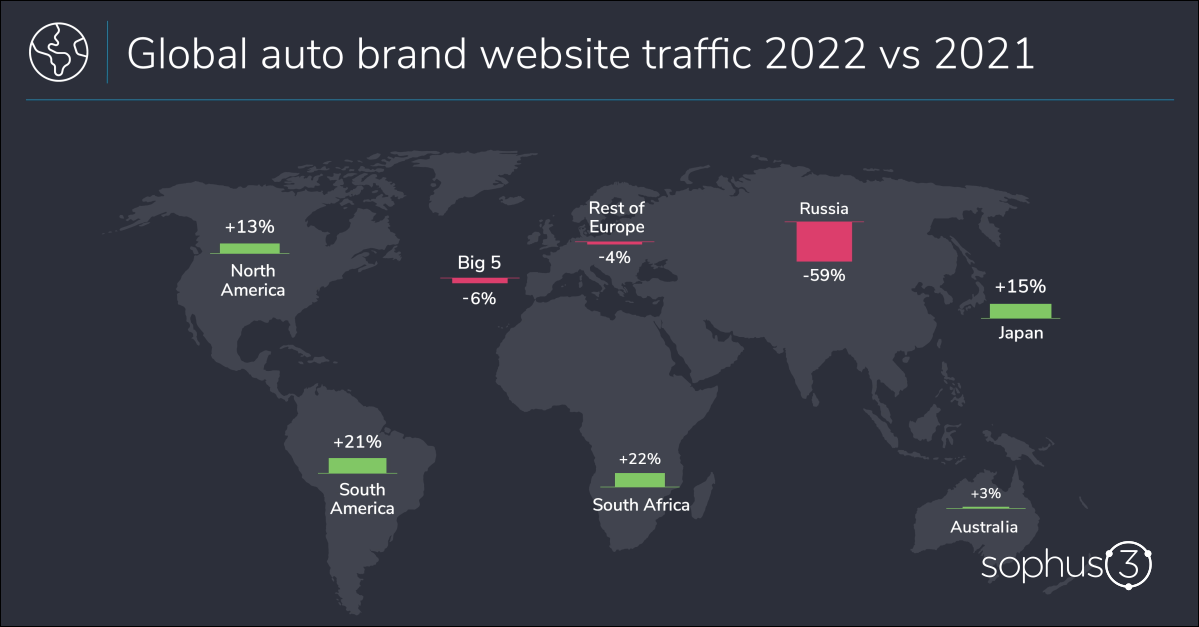

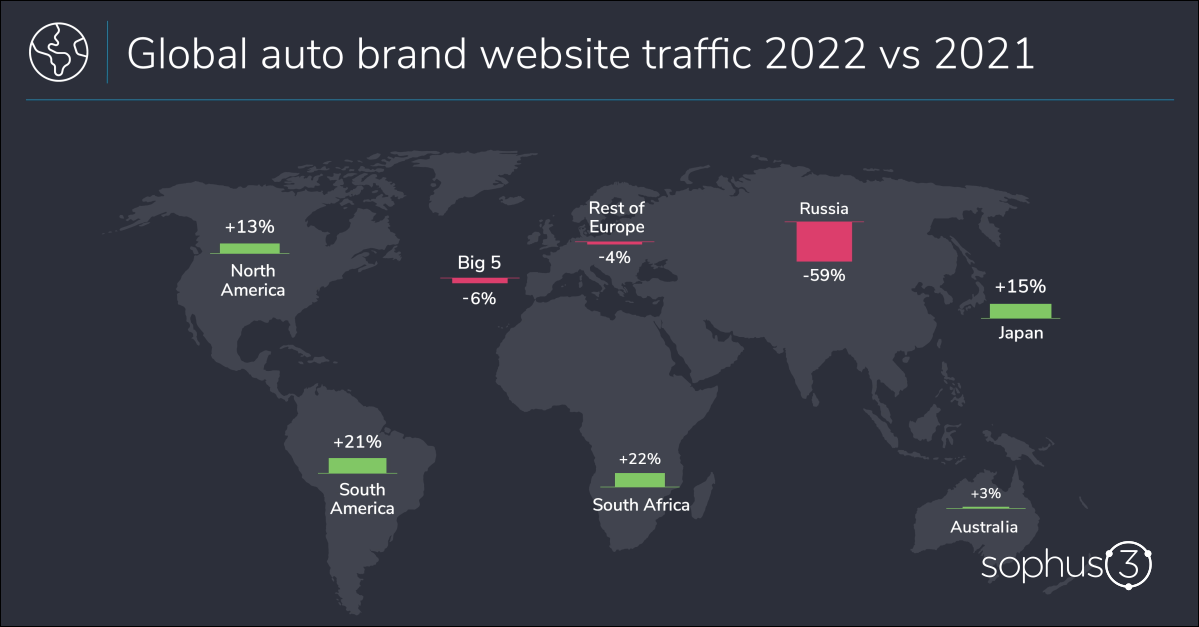

So it is perhaps surprising that many markets saw growth in digital audiences, but again, it’s uneven.

The US was down in new car sales, but its automotive digital audience increased. Our hypothesis is that car sales in this strange time are not necessarily a lead indicator of economic health, and interest remained strong in the US, resulting in sustained marketing spend despite a shortage of products. Europe, on the other hand, is seeing similar supply problems, but demand has weakened, leading to reduced marketing and smaller audiences.

This unprecedented volatility in both the market and the automotive business model means two things. The competition for buyers will be stronger than ever, and, second, digital will be the key battleground.”

Our video is accompanied by our annual white paper on the automotive digital landscape, Digital Car Buyer in Numbers 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

To understand how your brand truly competes online, contact Sophus3 head of insight, Patrick Fuller: patrick.fuller@sophus3.com