Share

Key takeaways from Sophus3’s recent auto digital webinar

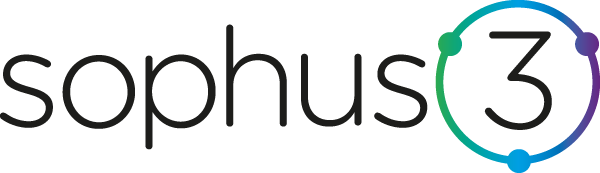

The Crisis of Engagement

The online car buyer remains elusive and difficult to engage with: the data that illustrates this was the starting point of the webinar that Sophus3 hosted exclusively for participants in the eDataXchange project this February.

This ‘crisis of engagement’ is a major challenge that car brands’ digital teams face:

- In the Big 5 European markets visitor numbers to OEM websites have strengthened over the last year but have yet to return to pre-pandemic levels

- Basic metrics such as bounce rates (the percentage of visitors exiting after viewing a single page), pages viewed per visit, and visitor dwell time are all heading in the wrong direction.

- But the variation in scores shows that there is plenty of scope for improvement to increase engagement. Audi Germany, for example, sees visitors to its site stay nearly four times longer than the worst performing brand, whilst visitors to Mercedes-Benz.de view twice as many pages as the market average.

What can OEM digital teams do to become ‘best in class’? Sophus3 shared a number of strategies, but restated the value of mystery shopping—testing the welcome and responsiveness of your website and other digital platforms just as you would a bricks and mortar showroom.

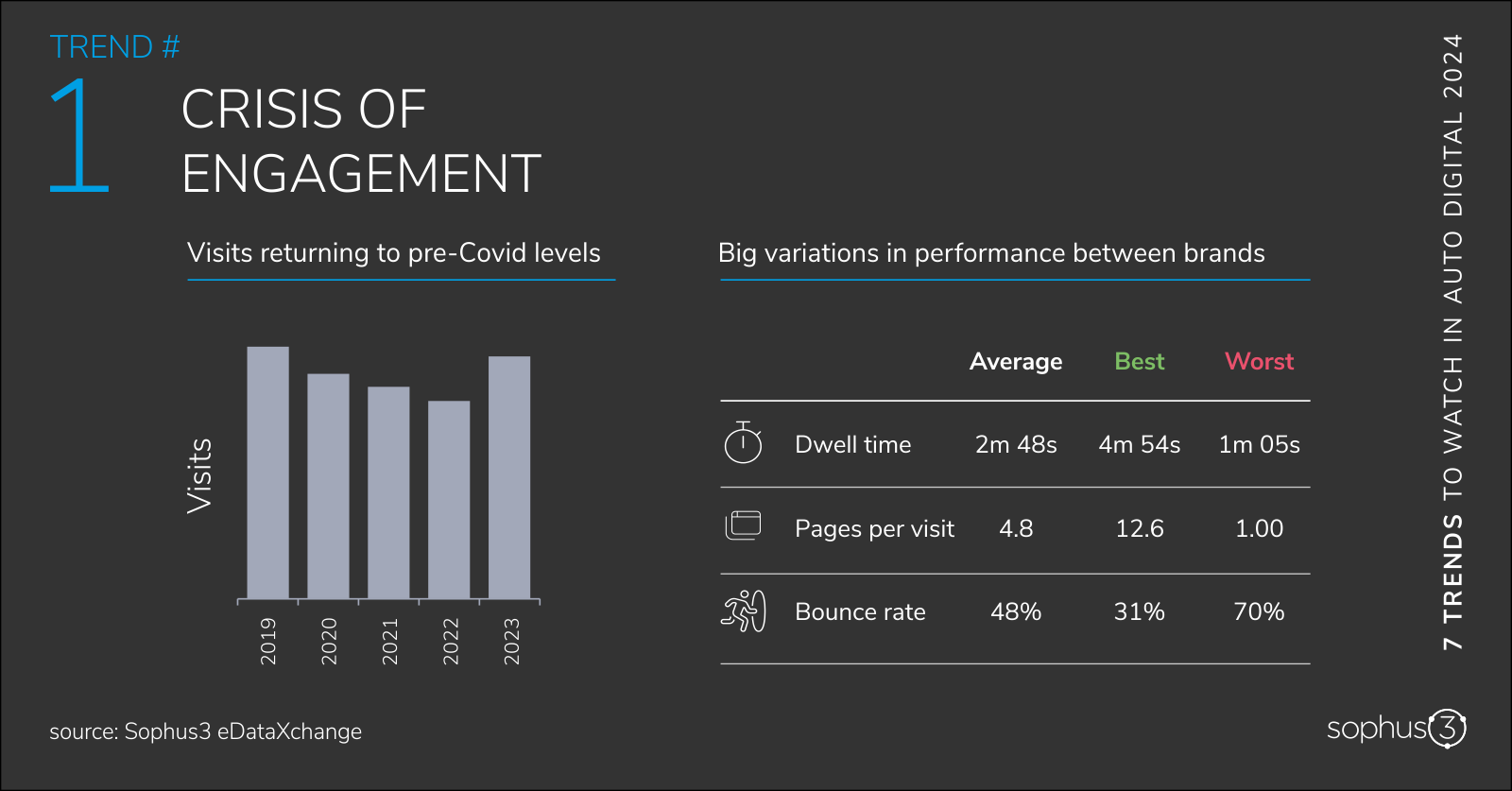

Why do premium brands struggle in digital?

Despite investing millions in their digital channels, car brands still find it hard to engage online visitors, suffering high rates of audience attrition. But how do they compare with other industries, particularly in premium sectors where the transaction value is also high?

To answer this Sophus3 undertook a study which benchmarked the digital performance of 35 non-automotive brands, which we divided into two categories. First, premium brands that sell high value and less frequently purchased products. Second, budget brands—including ecommerce marketplace sites—whose focus is on frequent, lower-price transactions.

As you can see from the graph, all of the premium brands in our study, including car brands, perform in a similar way. However, they all lag behind the budget brands in the three key engagement metrics. Transaction value, it seems, does not guarantee user engagement. Indeed, ‘everyday’ sites such as Amazon and Uber deliver a better online experience. Crucially, these familiar brands are shaping the expectations of online shoppers, who are becoming ever more demanding and intolerant. Which is perhaps not unreasonable given the price they are expected to pay for a car?

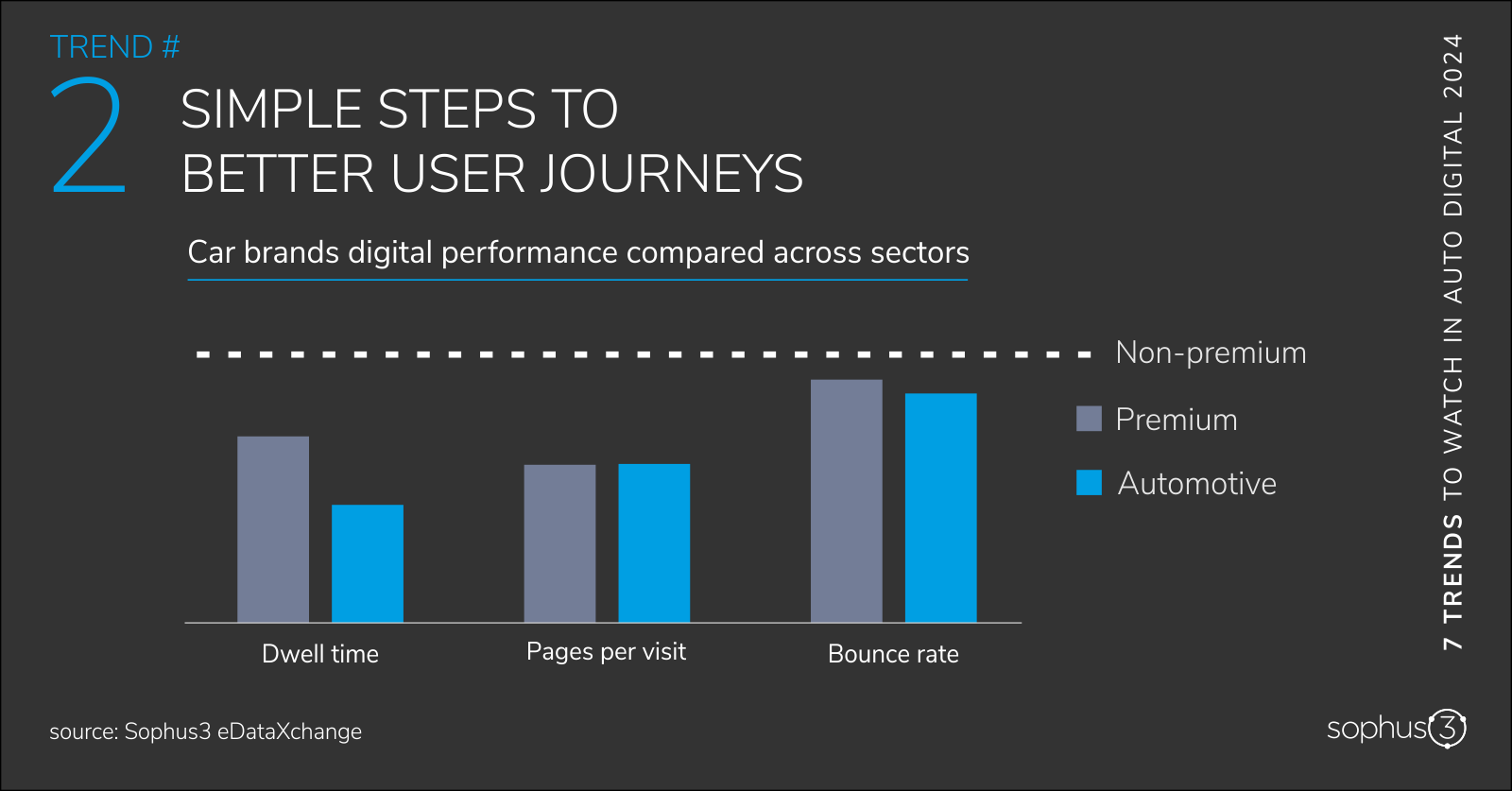

EV Interest has stalled

Online audience patterns are a bellwether for how likely consumers are to switch to an electric car and the cumulative data from the Sophus3 EV Index reveals that demand is showing no signs of recovery. Over the past three quarters, only Norway has passed the tipping point of mass acceptance, driven by legislative and fiscal measures put in place by the government.

(The EV Index is formed from three pillars: consumer interest, choice/affordability, and the availability of charging infrastructure. A score of 100 represents parity in the ease of purchase and ownership of an EV compared to an ICE vehicle.)

In markets other than Norway, as the graph of digital audience shows, consumer interest in EVs is consistently low. Pricing differentials are a key deterrent but long promised sub-€25,000 EVs have yet to arrive. In the meantime, car makers need to highlight total cost of ownership advantages as the primary pragmatic argument for consumers to switch.

Car brands in Europe will face an uphill struggle to meet this year’s EU CAFE and UK ZEV mandated targets for emissions given that registrations of battery electric vehicles flatlined in the last quarter of 2023 and even went into reverse in December, down -25% in Europe as a whole and -48% in Germany.

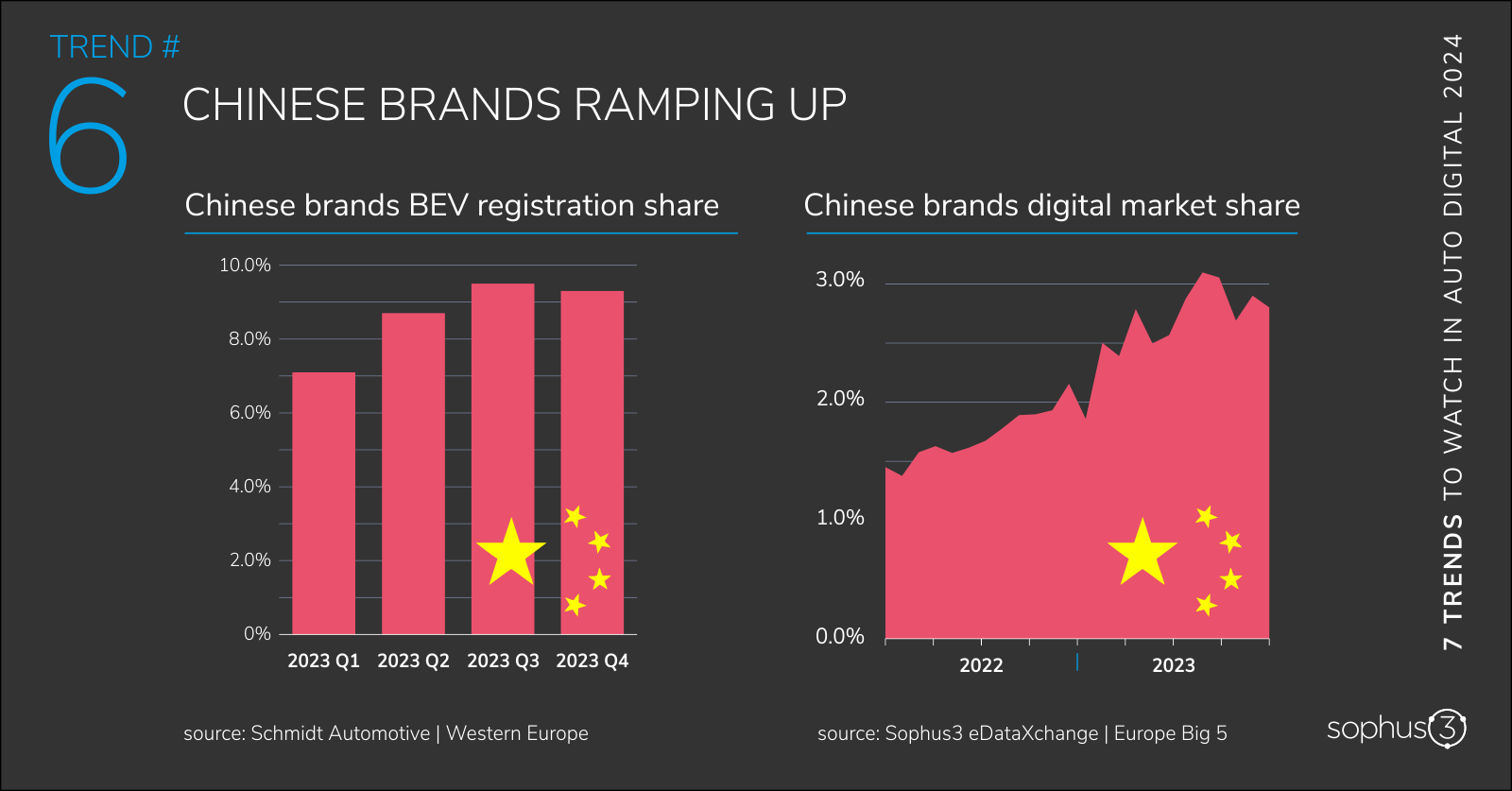

Chinese brands are ramping up their efforts

The latest Sophus3 analysis has identified no fewer than 17 Chinese brands active in key European markets, yet that could just be the start: there are more than 20 others with either explicit plans or products to do the same.

Chinese brands doubled their share of digital audience in 2023 to 3%—still a low number but impressive given their sparse investment in digital marketing.

Meanwhile, in terms of sales, Chinese brands won an impressive 8% of BEV (battery electric vehicle) registration share in key European markets in 2023. For now, the Chinese car makers are holding back on aggressive pricing, awaiting the findings of the EU investigation into government subsidies of Chinese produced cars. It may result in increased tariffs, but the huge differential between retail price in China and identical models sold in Europe suggests tariffs may have little effect. Conversely, it may make those European brands who strongly rely on sales in China, suddenly vulnerable.

How ready is your market for ecommerce?

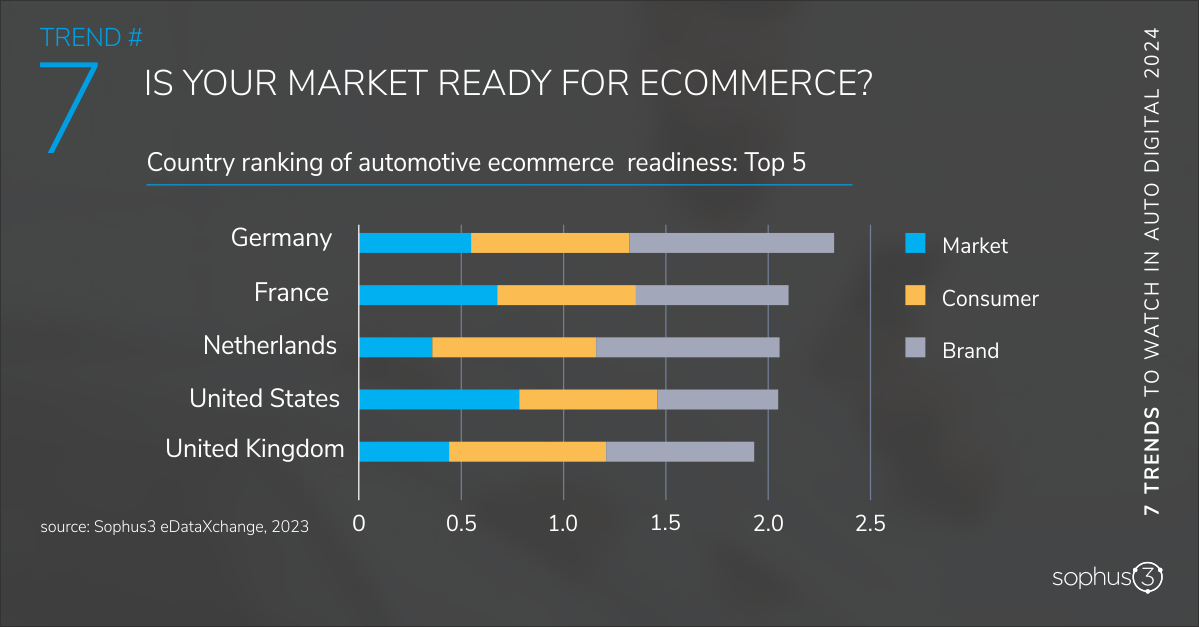

To answer this final question Sophus3 undertook a unique piece of research that included an audit of more than 600 websites in 24 of the world’s most significant vehicle markets.

We separated the drivers for ecommerce adoption into three strands:

Firstly, market health: indicated by GDP/capita, interest rates, consumer confidence, and the size of the addressable car market which, combined, shape the broad propensity for car purchase. Secondly, customer readiness, which measures access to and use of digital channels and the extent of engagement specifically with car brands through these channels. Lastly we assessed brand readiness: the range and sophistication of the tools made available for customers to enable an ecommerce purchase journey.

The results allowed us to index each of these drivers and combine them into an overall ranking by market. We share the Top 5 performers below.

The key takeaways:

- Germany topped the ranking because of the high number of brands offering a comprehensive range of ecommerce tools.

- In most markets consumers are ready for ecommerce.

- In some, market conditions are the barrier which means investment in ecommerce will not see immediate returns.

- There are a number of smaller markets—Ireland included—where implementation by brands is long overdue.

eDataXchange is a sector-wide, collaborative initiative through which car brands share data from their digital platforms so as to understand and benchmark their relative performance.

If you have any questions about the observations in this summary article, or want to find out more about how eDataXchange membership can help your digital performance, then please contact us.

Credits