Share

Sophus3 has published a later article on this subject available here: The Long March: Chinese car brands in Europe

Introduction

Chinese car makers have begun to make their presence felt in Europe with a number of recent high profile brand and vehicle launches. In Part 1 of this briefing document we looked at their strategy and identified the 40 or so Chinese OEMs that are currently—or likely to be soon—active within the region. With the incumbent brands potentially carrying a £10k price disadvantage on their EV models, they need to understand the digital approach of these Chinese challengers so they can defend their own audience and market share.

In this second and final part of our study, we look at these new entrants’ online presence, specifically their brand websites, to gain more detailed insight as to which markets these brands are present in, their current state of readiness and their digital capabilities. The information we share is based on a search for, and survey of, these websites carried out by Sophus3’s research team in late 2022, as well as analysis of online traffic to these sites over the previous four months.

Executive summary

- A survey of Chinese car brand European websites was conducted in November 2022.

- The sites of 14 groups/brands were analysed in nine European markets.

- There were 56 active sites out of a possible 126 with the highest number of ‘new entrant’ brands found in Sweden.

- MG was present in the most (all) markets. The larger groups (Geely, FAW, JAC) are represented by individual brands and do not have a public web presence themselves.

- The sites’ feature sets and functionalities were in many cases limited. Just over a half offered visitors a vehicle configurator and barely a third made reference to vehicle finance.

- Live Chat was offered on only a few sites despite its ubiquity amongst incumbent brands.

- 75% of brands are utilising a conventional dealer-based retail channel.

- Only four brands have a full ecommerce/‘click-to-drive’ capability.

- The digital audience the Chinese brands have acquired remains small with the exception of Norway where both Polestar and MG have won a larger audience share than the German premium brands.

- Established manufacturers should be concerned by the disruption to the brand hierarchy electrification may have caused and the opportunity this affords the new entrants.

About the survey

The aim of the site survey is to:

- identify which of the Chinese brands have a digital presence in the most important European markets

- review the features and interactive functionality their sites offer

- understand the retail model they are using and the proportion of brands that have a pure ecommerce capability

In addition we analyse the online traffic to these brand sites relative to the traffic to all car brand sites to quantify their share of the digital audience. The purpose of this is to see whether they are beginning to gain the awareness needed to win vehicle market sales.

The markets we looked at

Brands launching new EV models into Europe understandably focus their attention on those markets where electric vehicles already have some market share. In such markets there will be higher levels of awareness of EVs amongst new car buyers, whilst charging infrastructure will be in place to make EV purchase a feasible choice. The Scandinavian and Northern European markets currently enjoy the best EV sales, whilst Spain and Italy are also considered target markets because of their sales ranking by volume.

The study therefore looked at brand websites in the following nine markets which we identified as the most common entry points for these ‘new’ brands:

- Denmark

- France

- Germany

- Italy

- The Netherlands

- Norway

- Spain

- Sweden

- United Kingdom

The brands we tracked

As the first part of this briefing paper showed, there are a large number of Chinese brands either already active in the European market or considering entering it in the near future. We looked at vehicle registration data to see which brands are selling vehicles in larger quantities but also where even small registration activity suggests they might be readying demonstration fleets in preparation for a market launch.

Additionally we used sources in the business and automotive press to alert our researchers to announcements by brands of their launch ambitions. We therefore chose to look at the digital presence—or otherwise—of the following 14 groups/brands.

- Aiways

- BYD

- DFSK

- FAW

- Geely

- JAC

- Maxus

- MG

- NIO

- ORA

- Polestar

- Seres

- Wey

- Xpeng

Site features and functionality

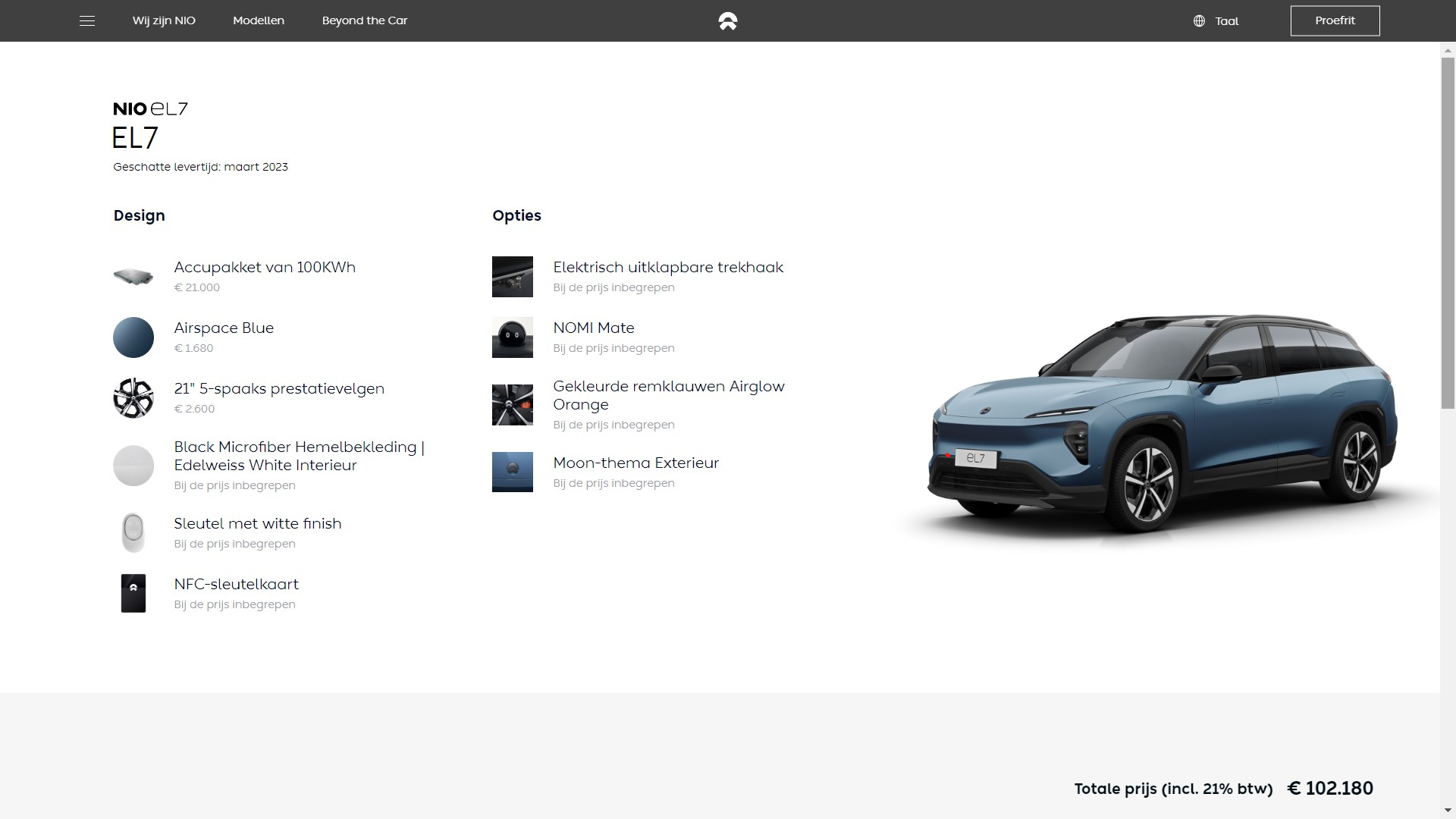

Our assessment of the new entrants’ website feature set looked at some basic capabilities so as to differentiate between brands that have cars to sell through a credible retail channel, as opposed to those which are mounting a digital holding operation—i.e. securing branded domains to safeguard the possibility of future market entry.

Our researchers therefore asked the following questions as they reviewed each site individually.

Model pages

Does the site have pages of information about each of the individual models the brand is offering for sale?

Derivative level pricing

Does the site show recommended retail prices for each car?

Configurator

Is there on-site functionality which allows a car buyer to choose equipment, select colour and trim combinations, and add options to an individual vehicle in preparation for ordering that vehicle?

Test drive request area

Is it possible for the visitor to request a physical test drive of the brand’s cars?

Live Chat

Can the site visitor interact with a representative of the brand in real time to ask questions about its products and services?

Register interest/subscribe to newsletter

Can the visitor register their details with the site to receive a call back or further information from the brand?

Finance/leasing information

Does the brand offer the customer assistance for the acquisition of its vehicles through its own finance offers?

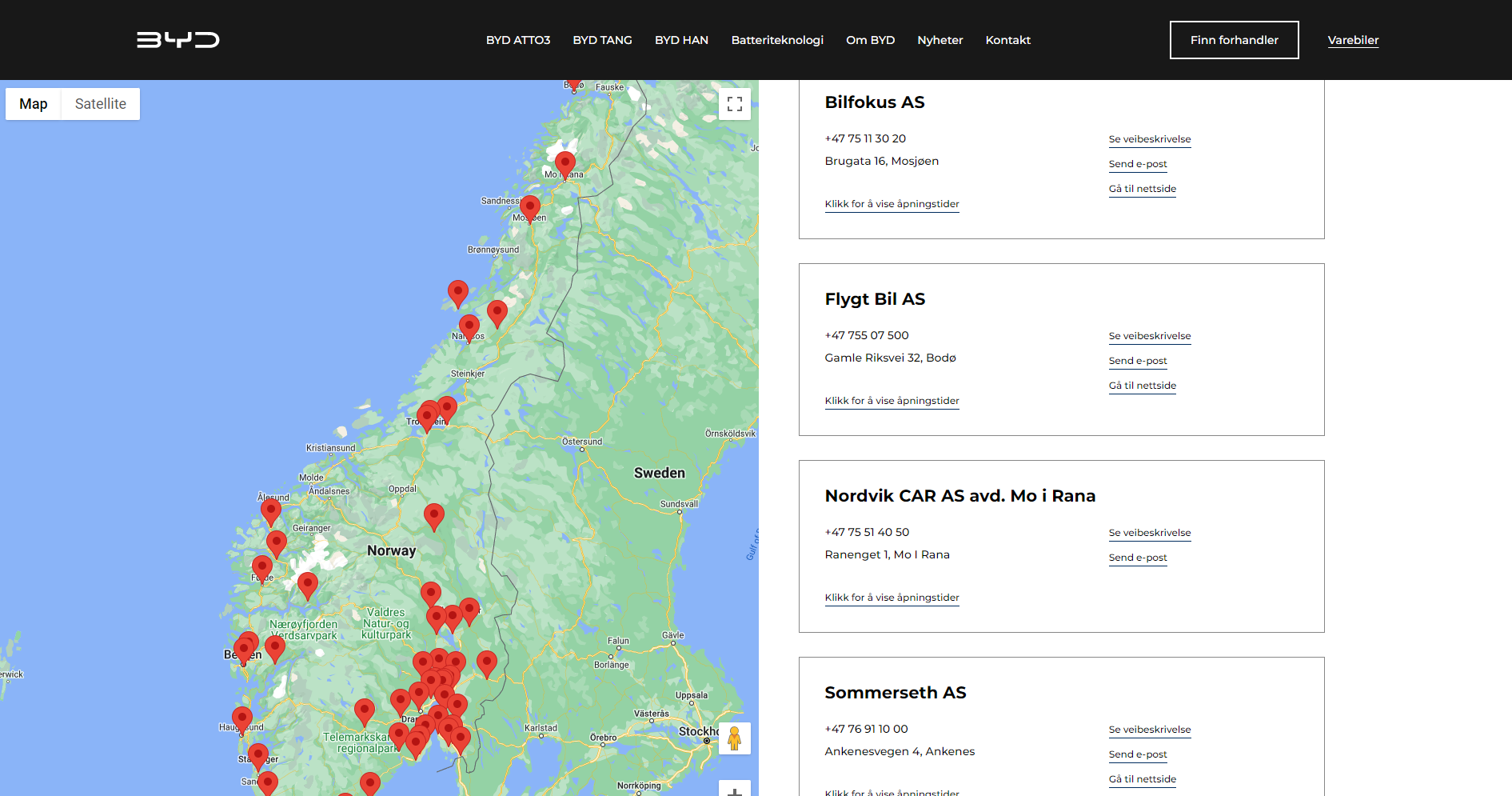

Find a dealer

Does the site have information—such as a listing or mapping functionality—to put the prospective customer in contact with a physical retail outlet?

Full ecommerce

Is it possible for the car buyer to choose, order and initiate payment for a vehicle online without having to visit a physical retail outlet during the ordering process?

Retail network or direct to consumer?

The last two of the above questions are designed to understand the business model of the brands. Are they planning to sell directly to the consumer—in the style of Tesla—or are they adopting the traditional model of directing online consumers to a bricks-and-mortar retail network to complete their purchase?

Findings

Markets and brands

Within the matrix of brands and markets we looked at we found 56 live sites out of a possible 126 (44%).

| Chinese car brand entrants by market | |

|---|---|

| Sweden | 9 |

| Germany | 8 |

| The Netherlands | 8 |

| Denmark | 7 |

| Norway | 6 |

| Spain | 5 |

| Italy | 5 |

| France | 4 |

| UK | 4 |

Sweden is currently the market with the highest representation of Chinese brand entrants, followed by Germany and The Netherlands.

Given the ‘poster girl’ status of Norway as the European market with the highest share of EV purchases this is perhaps unexpected.

The UK, despite being a success story for the MG brand, appears to be a low priority to others, presumably because it requires the supply of right hand drive vehicles.

Alongside the UK is France. Although a relatively mature market for EVs due to the early activity of Renault and consistent government support, it has the joint lowest number of new brand entrants. This may be a simple factor of geography. France has by far the largest land area of any Western European country so the cost of setting up a large distribution network may be off-putting to new entrants.

| Chinese car brand entry by market | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| DE | DK | ES | FR | IT | NL | NO | SE | UK | ||

| Aiways | 7 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✖ | ✔ | ✖ |

| BYD | 6 | ✔ | ✔ | ✖ | ✔ | ✖ | ✔ | ✔ | ✔ | ✖ |

| DFSK | 3 | ✖ | ✖ | ✔ | ✖ | ✖ | ✔ | ✖ | ✔ | ✖ |

| FAW | 0 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ |

| Geely | 0 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ |

| JAC | 0 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ |

| Maxus | 7 | ✔ | ✔ | ✔ | ✖ | ✔ | ✖ | ✔ | ✔ | ✔ |

| MG | 9 | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| NIO | 5 | ✔ | ✔ | ✖ | ✖ | ✖ | ✔ | ✔ | ✔ | ✖ |

| ORA | 2 | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✔ | ✔ |

| Polestar | 8 | ✔ | ✔ | ✔ | ✖ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Seres | 3 | ✖ | ✖ | ✖ | ✔ | ✔ | ✔ | ✖ | ✖ | ✖ |

| Wey | 1 | ✔ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ | ✖ |

| Xpeng | 4 | ✖ | ✔ | ✖ | ✖ | ✖ | ✔ | ✔ | ✔ | ✖ |

MG followed by Polestar are present in the highest number of European markets. (Polestar had been prevented from entering the French market because of a trademark dispute with Citroën over its double chevron logo which was recently resolved.)

Aiways is active in all markets except, perversely, Norway (although Norwegian car magazine Bil24 reported earlier in the year that this is about to change).

Whilst tiny numbers of Geely vehicles have been registered in Europe it is clear that all of the group’s vehicles are being sold under its various sub-brands.

Similarly, FAW does not have a web presence in Europe but it is selling a relatively large number of its Hongqi luxury brand SUV model which appears as a FAW vehicle in some registrations data.

JAC vehicles are rebadged under the DR brand in Italy and Spain, but the group does not appear to have any ambitions to enter Europe under its own name at present.

BYD, Nio and Ora—all highly visible participants in the recent Paris Auto Monidale—are confining digital activity to their launch markets, although that coverage will expand in the next few months if their stated launch timetables are adhered to.

Wey remains in the pre-launch phase with a page on its international site offering limited information (in English) to German customers.

Site features and functionality

The percentages in the table that follows show the features available across the live sites that we located and reviewed as outlined in the previous section.

| Chinese brand site features | |

|---|---|

| Model pages | 96% |

| Derivative level pricing | 75% |

| Configurator | 55% |

| Test drive | 79% |

| Live Chat | 38% |

| Register interest/subscribe | 77% |

| Finance/leasing | 39% |

| Find a dealer | 79% |

| Full ecommerce | 29% |

updated 10/01/2023

Members of Sophus3’s eDataXchange project can request the detailed breakdown by brand and market through contact@sophus3.com.

The feature set of the new market entrants appears to be limited at this moment in time in key areas, suggesting that many of the brands are still some way from seriously competing for sales.

As you would expect, the majority of brands are showing some details about the vehicle models they offer, but only 75% of sites give derivative level pricing—the binding price that the customer would pay—which suggests that their vehicles are not yet available for purchase. The fact that a customer is unable to use a configurator to specify a vehicle to their own preferences on nearly half of the sites reviewed also supports that conclusion.

Whilst more of this group of brands offer a test drive—79% of live sites have this feature—it would seem questionable whether all of these are in a position to fulfil a request and are instead collecting ‘expressions of interest’ from site visitors. (The percentage of sites offering such a feature separately is remarkably similar).

Just 38% of the sites offer real-time communication through Live Chat. Our most recent site survey of the automotive sector found that more than 75% of the incumbent brands in the European Big 5 offer this feature on their sites (many with sophisticated video chat and virtual showroom functionality). Over the last couple of years Live Chat has moved from a ‘nice to have’ to a critical engagement tool—a shift accelerated by showroom closures during the Covid pandemic and consumers demand for rapid and personalised interaction.

The final indicator of these brands’ market readiness also achieved a low score. Barely one third of the sites we looked at offered or even mentioned vehicle finance. This is something many of the new entrants will need to address before they go truly ‘live’, given the significance of brand finance within the European new car market. For the incumbent OEMs, clever finance packages allow them to win and retain customers but also provide a source of profit in a market with traditionally wafer thin margins.

Retail network or direct to consumer?

Our research shows that the majority of Chinese brands entering the European market are currently utilising a traditional dealer network arrangement and promoting contact to this through their websites—79% of them have links to contact their network.

Only four of the brands we reviewed are going with a direct to consumer, digital model at the present time. These are Polestar and Nio along with Aiways and Xpeng—although the latter two only promote full ecommerce capabilities in a single market each.

Share of digital audience

So how digitally effective are the new Chinese brands as they ramp up efforts to attract European consumers to their brands and products? The simplest measure is to calculate the share of audience to their websites compared to the incumbent brands, using the number of tracked visits.

In most markets we find the audience for these individual brands is negligible, and even their combined total is barely significant. For example, in Germany, we calculated that between August and November the combined traffic of the Chinese brands was just over 2% of the whole.

However, in Norway—the entry point for many of these brands—we can see a much stronger performance over the same period.

| Digital Market Share Norway | |

|---|---|

| Tesla | 13.0% |

| Toyota | 9.9% |

| Volkswagen | 8.4% |

| Renault | 6.7% |

| Volvo | 6.4% |

| Polestar | 4.9% |

| Hyundai | 4.9% |

| MG | 3.2% |

| Kia | 3.0% |

| BMW | 3.0% |

| Nissan | 2.9% |

| Audi | 2.9% |

| Skoda | 2.7% |

| Voyah | 2.6% |

| Mercedes-Benz | 2.6% |

| Ford | 2.5% |

| NIO | 2.2% |

| BYD | 2.0% |

| Porsche | 1.6% |

| Peugeot | 1.4% |

| Citroen | 1.3% |

| Hongqi | 1.3% |

| Subaru | 1.1% |

| Opel | 1.0% |

| Jaguar | 0.9% |

By audience size, Polestar and MG ranked in sixth and eighth place respectively, putting them ahead of all of the German premium brands (BMW, Mercedes-Benz and Audi). Voyah, Nio, and BYD, each a relative newcomer, were in the list of top twenty most visited sites and ahead of the established brands of the Stellantis group (Peugeot, Citroën and Opel). Together, the Chinese brands’ combined share of audience was an impressive 16.2% of the total.

Are Norwegians more ‘brand agnostic’ when it comes to choosing a new car and therefore more open to considering the products of Chinese OEMs? Perhaps, but this insight into consumer behaviour will certainly make the established brands take notice. As the new players enter and expand their activities into other markets will we see them make similar gains in audience? Curiosity may be an initial driver for this online interest, but the incumbent OEMs will be concerned about two things. Firstly, the genuine appeal that these brands and their products may have. Secondly, and perhaps more worrying for them, is that the shift to electric power has perhaps upended the existing brand order: the established OEMs will need to prove themselves on this new playing field where their prestige, built over many years, may now count for little.

Conclusions

The findings from this survey of Chinese brands’ digital capabilities are somewhat underwhelming. Many of the sites we looked at have a very basic feature set and limited functionalities.

We expected these car makers to have essential online modules in place to entice and enable vehicle purchase, with strong offers on the finance front. We were surprised to find relatively few of these entrants offering a Live Chat facility to potential customers.

We had also been expecting a larger number of the Chinese brands to have more advanced ecommerce capabilities or at least hybrid sales channels which included the possibility of ‘click-to-drive’. Chinese consumers are reportedly more comfortable with online car purchase than their European counterparts, and this—along with the well-documented success of Tesla using a direct to consumer (D2C) approach—would seem to have favoured the new Chinese entrants defaulting to a D2C model at start up.

Yet as we have seen, the majority are pursuing a conventional route to the customer through partnerships with a range of dealer groups across Europe, thereby replicating the market norm. Perhaps this approach makes sense, particularly in this initial phase of market entry. Tie-ins with large retail groups give the entrants an instant distribution footprint, and maybe even more importantly, lends credibility and recognition to these often completely unknown brands through their association with well established and trusted businesses.

It must also be said that things are moving rapidly. In the month since we carried out the survey we have seen new sites appear, with brands adding features to existing sites. Sophus3 will continue to monitor the progress of the Chinese brands’ European entry and will update and share our analysis as events unfold.

If you have any comments or questions about this paper, then please email us at contact@sophus3.com.

Follow Sophus3 on linked in to receive the latest updates: https://www.linkedin.com/company/sophus3/

This page was updated on 12/01/2023 to reflect recent additions in site functionality to the following BYD brand websites: www.bydauto.dk, www.byd.com/fr, and www.bydauto.nl.

Credits

Written by Paul Rutishauser; data research and analysis by Liliana Starzyk, Sam Robson.